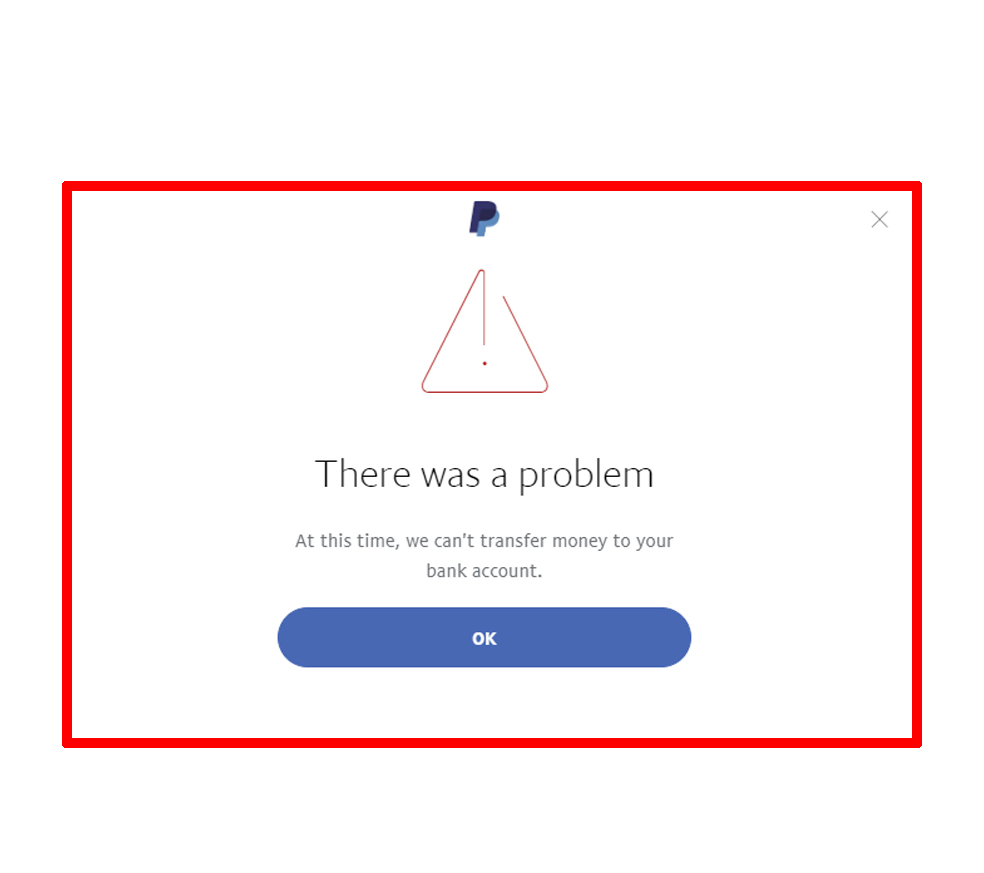

Are you one of those frustrated PayPal users encountering the vexing issue of being unable to send or transfer money from your PayPal account to your bank? We understand the frustration and inconvenience this error can cause, especially when you’re trying to manage your finances efficiently. The good news is that you’re not alone in facing this problem, and there are solutions available to help you resolve it.

In this guide, we’ll walk you through the common causes behind the ‘Unable to Send/Transfer Money from PayPal to Bank’ error and provide step-by-step solutions to get you back on track.

Common Causes of the Error

Before delving into the solutions, let’s shed some light on the common causes that might be triggering this issue. It’s important to understand these causes as they can help you pinpoint the source of the problem and choose the appropriate solution.

- Incorrect Bank Information: Sometimes, the simplest oversight can lead to complex issues. Double-check that the bank details you’ve entered in your PayPal account are accurate. A typo or outdated information can prevent successful transactions.

- Insufficient PayPal Balance: If your PayPal balance isn’t sufficient to cover the transfer amount, the transaction will fail. Ensure that you have enough funds in your PayPal account to complete the transfer.

- Bank Account Not Linked: Is your bank account properly linked and verified in your PayPal settings? If not, the system won’t allow transfers until you’ve completed the necessary verification steps.

- Pending Transactions or Holds: If there are pending transactions or holds on your account, it might temporarily restrict your ability to transfer funds. Clearing these issues can resolve the problem.

- Network or Browser Issues: Glitches in your network connection or problems with your browser can disrupt the transfer process. Ensure you have a stable internet connection and try using a different browser.

- Security Checks: PayPal’s security measures might occasionally flag a transfer as suspicious. If this happens, you’ll need to verify your identity and intent before proceeding.

- Account Restrictions: In some cases, limitations or restrictions on your PayPal account can prevent outgoing transactions. This could be due to various reasons, such as suspicious activity or compliance issues.

- Outdated App or System: If you’re using the PayPal mobile app or website, ensure that you’re using the latest version. Outdated software can lead to compatibility issues.

Troubleshooting Procedures

Now that you’re aware of the potential causes, let’s move on to the solutions. Below are eight solutions that can help you overcome the ‘Unable to Send/Transfer Money from PayPal to Bank’ error:

Solution 1: Verify Bank Information

Why is it necessary to do it?

Verifying your bank information ensures that the details you’ve provided are accurate, minimizing the chances of transfer failure due to incorrect data.

How is it done?

- Log in to your PayPal account.

- Go to your Wallet.

- Select the bank account in question.

- Click on Edit and review the information.

- Make any necessary corrections and save the changes.

Solution 2: Add Sufficient Funds

Why is it necessary to do it?

Maintaining a balance that covers your intended transfer amount guarantees a successful transaction without any hiccups.

How is it done?

- Log in to your PayPal account.

- Ensure you have enough funds in your PayPal balance or link a funding source.

- If needed, transfer funds from your linked bank account to your PayPal balance.

Solution 3: Verify Bank Linkage

Why is it necessary to do it?

Verifying your linked bank account confirms its authenticity and allows for seamless transfers.

How is it done?

- Log in to your PayPal account.

- Go to Wallet.

- Choose the bank account and click on Confirm or Verify.

- Follow the provided instructions to complete the verification process.

Solution 4: Resolve Pending Transactions

Why is it necessary to do it?

Clearing pending transactions or holds removes obstacles that might be preventing your transfer.

How is it done?

- Log in to your PayPal account.

- Check for any pending transactions or holds.

- If possible, complete or cancel these transactions to clear your account.

Solution 5: Check Network and Browser

Why is it necessary to do it?

Ensuring a stable internet connection and using a compatible browser eliminates potential technical glitches.

How is it done?

- Verify your internet connection stability.

- If using a browser, clear cookies and cache.

- Try using a different browser to see if the issue persists.

Solution 6: Verify Identity for Security Checks

Why is it necessary to do it?

Verifying your identity establishes your credibility and clears any security flags on your account.

How is it done?

- Log in to your PayPal account.

- Look for any notifications about identity verification.

- Follow the provided steps to verify your identity.

Solution 7: Address Account Restrictions

Why is it necessary to do it?

Resolving account restrictions ensures that your PayPal account is in good standing for transactions.

How is it done?

- Log in to your PayPal account.

- Check for any notifications or messages regarding account limitations.

- Follow the instructions provided to address the restrictions.

Solution 8: Update PayPal App or System

Why is it necessary to do it?

Using the latest version of the PayPal app or website prevents compatibility issues that could disrupt transfers.

How is it done?

- Visit your device’s app store or the PayPal website.

- Download and install the latest update for the PayPal app.

- If using a browser, ensure it’s updated to the latest version.

Remember, these solutions are designed to tackle various potential issues causing the ‘Unable to Send/Transfer Money from PayPal to Bank’ error. By following these steps, you’ll increase your chances of successfully resolving the problem and regaining control over your financial transactions.

Encountering the ‘Unable to Send/Transfer Money from PayPal to Bank’ error can be frustrating, but armed with the right knowledge, you can troubleshoot and fix the issue.

Addressing common causes like incorrect bank information, insufficient balances, and verification processes, along with verifying your identity and staying updated, can pave the way for smooth and hassle-free transactions. So, if you find yourself facing this issue, don’t worry—you’ve got the tools to tackle it head-on and get back to managing your finances with ease.

Transfer Money from Paypal to Bank FAQs

-

What should I do if I encounter an error while trying to transfer funds online?

If you encounter an error during an online fund transfer, the first step is to remain calm. Errors can occur for various reasons. Start by checking your internet connection and ensuring you’re using a compatible browser or app. Double-check the recipient’s information to ensure you haven’t entered any incorrect details. If the problem persists, reach out to your bank or financial institution’s customer support for assistance. They can provide insights into the specific issue and guide you through the necessary steps to resolve it.

-

Why did my online fund transfer get declined, even though I have sufficient funds in my account?

While having sufficient funds is essential for a successful transfer, there are other factors that could cause a decline. It’s possible that your bank has security measures in place that flagged the transaction as potentially fraudulent. Additionally, there might be restrictions on your account that prevent certain types of transactions. To address this, get in touch with your bank’s customer support. They can help you understand why the transfer was declined and provide guidance on resolving the issue.

-

I received a confirmation for an online fund transfer, but the recipient claims they haven’t received the funds. What should I do?

In situations where a confirmed transfer hasn’t reached the recipient, it’s important to take immediate action. Start by verifying the transaction details in your account to ensure there were no errors in the recipient’s information. If everything appears correct, ask the recipient to double-check their account details as well. Sometimes, delays can occur due to processing times between different financial institutions. If the issue persists, reach out to your bank or payment service provider. They can initiate an investigation to track the funds and provide you with updates on the transfer’s status.